In the past financial oligarchs controlled industrial firms through a creditor's status. Access to capital was contingent on providing banks with seats on the board or other similar arrangements. This was an open and direct mechanism of control which bankers flaunted, and was the noticable characteristic of financial capitalism, a period roughly spanning 1850-1930.

This period of bankers credit control is synonymous with the gold standard and ended along with it around 1930. When domestic world currencies started to be removed from their pegs to gold, monetary policy started to become inflationary, meaning that future claims on money lost value over time. Because of this the profit to be made off crediting money began to diminish and it was no longer advantageous to be a creditor in perpetuity.

Because of this, these financial oligarchs began to transition the bulk of their wealth into assets which derived rent as opposed to interest. These assets were predominantly land, rare art, and metals; things with fixed scarcity and reliable authenticity which could be used for a safe storage of value, but could also generate them rents in modest amounts for liquidity purposes, modest only to the relative wealth stored (or hidden) within the assets themselves.

An example of this would be a painting purchased for $50 Million, evaluated at twice that by a queef with eccentric hair to conjure value, as to be rented at that markup in safe keeping by a publicly subsidised art gallery, curated by yet another queef—or generously donated fixed term as a tax write off.

Separation of control from ownership

Between 1920 and 1940 these fantastic estates amassed by financial houses such as Morgan, Mellon, Rothschild, and Rockefeller all appeared to evaporate at once into modest dispersion's between dynasty scions, philanthropic foundations, art collections, and complex trust structures. And while this relived this international banking fraternity of the robber Barron image such flagrant wealth attracts, so did it too their creditor status, which had formerly been used to control corporations through direct ownership.

Is it generally misunderstood that the gold standard was abolished by Richard Nixon in the 1971. What Nixon actually abolished was the gold exchange standard for central banks, which was adopted in the wake of WW2 when the US dollar became the reserve currency for foreign exchange . Private citizens and firms could not exchange US dollars for gold under this system.

The actual gold standard for domestic currency exchange was departed from unofficially to finance World War 1, and then later in official terms of monetary policy around 1930 when the Bank For International Settlements was established.

This post-gold standard epoch of 1930 is also generally and unfortunately—authoritatively, thought to mark the end of the international banking fraternity’s reign over their respective Nation's economies and industries. It is thought that due to the power of their creditor status waning, that they were gradually eclipsed by the technocratic entrepreneurs of the modern technology corporations, which had grown to generate enough profit to self finance perpetual growth, meaning they were no longer beholden to banks for access to capital. Banks did lose creditor status control over modern corporations, but they did not lose control of them.

The international banking fraternity achieved this through a separation of ownership from control; by handing ownership of corporations gradually over to a collectivised working, middle, and professional class amalgamation of savings, all while attaining custodianship over the control this ownership purchased.

What was instituted was a kind of quasi-Communism in theory. Gradually a communal ownership over the means of production arose, which was then controlled on this collectives behalf by a custodianship of banks. Remember, Marx wrote about the collective ownership of production, not control. And very briefly too.

To test that control has been separated from ownership you may pick any of the largest multi-national corporations and look at their majority stock owners. You will find in nearly all cases the majority stockholders to be open-ended index-linked mutual funds, which are predominantly made up of peoples pensions. This proves the means of production is predominantly owned by a collective of capital amassed from the pensioned workforce.

To test that control has been separated from this ownership of production, ask anyone with a pension how they vote their shares. The majority won’t know they own shares, if they do most won't know what they own, even fewer that they purchased voting rights to it. Most won’t care so long as the dividends are there.

Which begs a question. Who is voting all this stock and how are they voting it? Control has been separated from ownership.

The two major mechanisms created to facilitate this separation of control from ownership first appeared in conjunction of one another during the 1920s, right during the lead up to the coming crashes, ensuing depressions, successive abolishments of the gold standards, and the proliferation of Keynesian monetary policy through the 1930s. These mechanisms were the mutual fund and the custodian bank.

The Massachusetts Investors Trust was the first open-ended mutual fund in the United States, founded by Ashton L Carr in 1924. It aggregated the savings taken from middle class incomes into bulk purchases of company stocks. To put it simply, MIT collected communal capital and directed its purchase of production. For this it kept a fee and passed the rest of its profits or losses onto its customers, who legally owned the stock. What was unique about this arrangement was that MIT used a Custodian Bank called State Street to hold stock it purchased on behalf its customers in a type of escrow arrangement, which granted State Street the privilege of voting that stock via proxy on behalf of the customers who had purchased it. This arrangement between MIT and State Street is the genesis of modern corporate control and where its divergence from ownership began.

Another other notable mutual fund created in this period was the Wellington Fund founded by Walter L Morgan in 1928. It was the first fund to include bond purchases in its portfolio, an asset (or rather liability) that would slowly make the middle classes into a class of creditors through their retirement savings.

To conceptualise this system clearly I am describing three distinct roles:

1) Ownership

2) Management

3) Control

All three in relation to an asset(Corporate Stock) that has two distinct rights:

1) rights to corporate profits through dividends

2) voting rights to elect corporate management

Involving three distinct groups:

1) Anyone on a pension linked salary(I will just call this the middle class for simplicity)

2) Mutual Funds.

3) Custodian Banks.

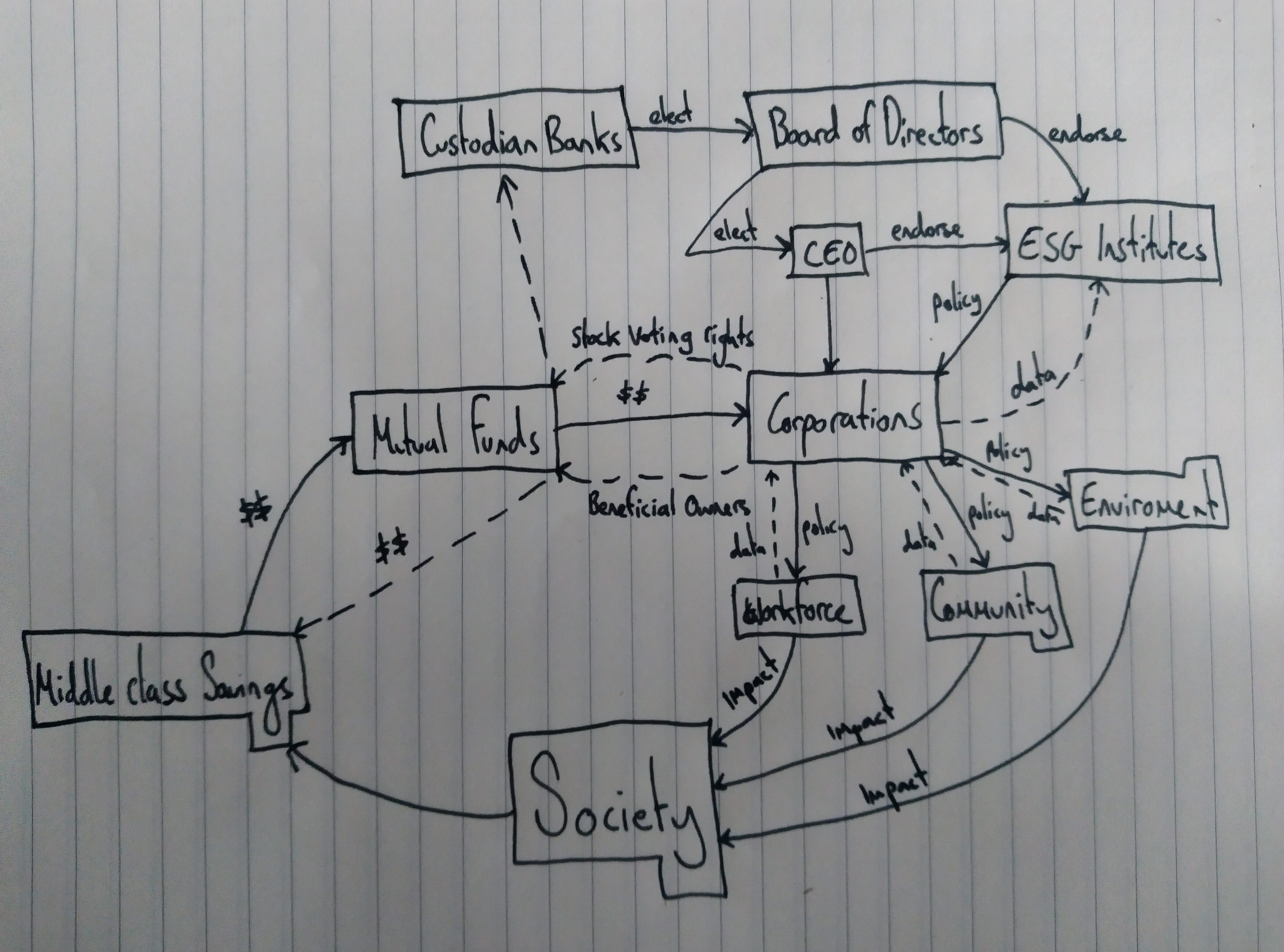

The middle class provides capital to mutual funds through their savings. Mutual funds manage the purchase of corporate stock on their behalf, taking a fee for the service and returning corporate profits or losses back to the middle class. The mutual funds upon purchasing the stock transfers the voting rights of it to a third-party custodian bank. The custodian bank then votes the proxy of this stock owned by the middle classes to elect the boards of corporations, who in turn elect their CEOs who in turn control the operational management of corporations.

The steps of this process:

- Capital is taken from middle class savings.

- This capital is pooled together by Mutual funds, that use it to purchase voting blocks of corporate stock.

- Mutual funds transfer the custody of this stock to Custodian banks who use it as voting blocks to elect corporate board members.

This is a simplified version of the system which is much more complex in practise, but it must be simplified so that the effective outcome still remains clear as further complexities ostensibly muddy the waters.

Division of control in the modern corporation

Corporations have two primary relationships to their environment. To the market, being a corporation-to-corporation relation. And to society, being a corporation-to-people relation. These distinct relations are governed by separate policies: Operational policy and Social policy.

A technocracy of specialised expert committees, or corporate managers, must be left the autonomy required for them to effectively achieve their corporations sole function within the market, which is perpetual growth. The nature of modern technology necessitates this due to a need for advanced planning and specialised expertise. If an external power such as a corporations board of directors were to impede on the operational autonomy of their technocracy, growth would be stunted and growth is a mutual objective for both parties. For this reason, even though corporate boards have the power to infringe upon the operational decisions of the technocracy, they very rarely do. Which leaves the operational control of corporations largely to the corporations themselves.

So when it is said that Custodian banks control corporations through electing their boards, it is not meant to imply that they do not allow power to preside where it must for growth. For the very point of control is for it to be over those corporations which grow the most. This is due to the other relation, that of corporations-to-people.

How corporations relate to people is governed by a social policy which is beyond the purview of the technocracy. Traditionally this would be somewhat associated with HR departments, though currently this social policy is being clearly pronounced as a framework called Environmental, Social, Governance; or ESG policy.

ESG broadly covers environmental responsibility and social controls of the corporate workforce, including such things : employee health, employee rights, and employee further education. This is the vertical integration of people into corporate citizens, of whatever you would call the current State into a Corporate State. It determines corporate endeavours that influence societal attitudes through mechanisms such as cancel culture. Cancel culture is not a corporate reaction to community action, but quite the reversal.

ESG policy is corporate social control delivered in a poison pill alongside Corporate environmental responsibility, making the latter contingent on the former.

However, corporations do not govern their own ESG policy. The technocracy is only concerned with operational policy within the market. Which leaves ESG policy exclusively determined by CEOs. These CEOs are beholden to corporate boards who elect them, who in turn are beholden to custodian banks that elect them with voting blocks owned and purchased by the middle class via mutual funds.

Corporate control is divided between two interests:

1) Operational control by internal middle managers.

2) Social control by custodian banks.

The first is direct and easily noticeable. The second is tacit and uses proxies. Because of this a distinction between the two is never made and social control is mistakenly attributed to middle managers which make up the monolith of “the corporation”.

Mutual Funds

The funds take middle class retirement savings and bundle them into capital used to purchase corporate stock. The stock comes with rights to profits and votes. The profits(or losses) are returned to the middle class while the voting rights are retained by the funds, called voting blocks. The larger the capital the larger the voting blocks purchased, and voting blocks are what control corporations. For this reason funds like Vanguard have very low fees, almost inexplicably. They want voting blocks more than profit off service fees, as the former is power and the latter unpurchased power. As of Jan 2021 Vanguard had $7.2 trillion in assets under management.

So mutual funds purchase two things:

1) Stocks, which are beneficial ownership rights

2) Voting blocks, which are custodian controlling rights

The investment company act of 1940 made it law for mutual funds to transfer these voting blocks to a third-party custodian bank licensed by the SEC. By law Mutual funds are purchasing agents for custodian banks:

"(b) Except as provided in paragraph (c) of this section, all such securities and similar investments shall be deposited in the safekeeping of, or in a vault or other depository maintained by, a bank or other company whose functions and physical facilities are supervised by Federal or State authority. Investments so deposited shall be physically segregated at all times from those of any other person and shall be withdrawn only in connection with transactions of the character described in paragraph (c) of this section."

The biggest funds are index linked funds and by definition purchase large segments of stock in the largest multi-national corporations. The two major ones are the Vanguard group and Blackstone group(BlackRock). If you look up the largest stockholders of multinationals you’ll find these two groups with a stake in almost every one. The Vanguard Group had $7.2 trillion in assets under management as of January 2021. BlackRock had $8.68 trillion in assets under management as of January 2021.

Vanguard was the first index linked fund, created as a runoff the Wellington Management Fund by John Bogle in 1974. Vanguard is quite an engima, Blackstone less so.

The Blackstone Group was founded by Peter G Peterson and Stephen Schwatzmann in 1985. Peterson’s prior career orbited Rockefeller family interests. Schwatzmann was a Yale alum, Skull & Bones class of ‘69. The group financed BlackRock in 1988, which was made up of former employees from First Boston, a bank owned by the Mellon family. The principal person at BlackRock being Larry Fink, who had headed First Boston’s mortgages and securities department during the Savings and Loans Crises ‘88, which was the same scam as the ‘08 financial crises only done with commercial properties instead of residential.

Custodian Banks

The easiest way to convey the influence of custodian banks is to simply give a list of the current holdings of the largest ones in US dollars.

BNY Mellon, as of December 2020, $41.1 trillion in assets under custody.

- Source

State Street, as of December 2020, $38.8 trillion in assets under custody.

- Source

JPMorgan Chase, as of October 2020, $27.8 trillion in assets under custody.

- Source

Citigroup, as of December 2019, $21.2 trillion in assets under custody.

- Source

BNP Paribas, as of December 2019, $11.8 trillion in assets under custody.

- Source

These top five have a combined $140.7 trillion in assets under custody. . .

Citigroup and JPMorgan Chase are historically Rockefeller family institutions. BNY Mellon is the Mellon family. BNP Paribas is the French branch of the Rothschild family.

Proving control of these banks still remains with these families would require traversing the impossible to navigate mergers and acquisitions history they have under gone since WW2. If you look at their stock holders, the very mutual funds they are custodians of are their majority stockholders. Meaning custodian banks are the custodians of their own stock.

The standard of proof set for proving who is behind these institutions is impossible to meet. We are all quite aware of the extensive tax heaven network that permeates throughout the former European colonies. Most of which leads back to the City of London and other jurisdictional anomalies that are controlled by their own private governments and police forces. If these institutions where still controlled by these financial dynasties that founded them in the 19th century it would be impossible to prove.

One can only conjecture as to why the wealth of all these families seemed to suddenly disappear, all at once; right around when global economies went off the the gold standard; into an ever influential network of philanthropic foundations and rare art auctioning markets.

The separation of control from ownership is legislative and formal

In many countries it’s compulsory to pay a portion of income into a government approved mutual fund for the purchasing of stock Then a mutual fund, at least in the United States where the biggest reside and generally incorporate in Delaware, must transfer the voting blocks bought with those stocks to a custodian bank. The only custodian banks are those licensed by the SEC, all of whom have the same contractual obligations and conditions in regards to proxy powers over those voting blocks. There is no choice in the matter and no trickery. The entire process hides in plain sight and is legal, so by definition cannot be a conspiracy.

This is a clause from the JPMorgan Chase Master Custody Agreement signed by 1290 mutual funds.

(v) J.P. Morgan being required to vote all shares held for a particular issue for all of J.P. Morgan’s customers on a net basis (i.e., a net yes or no vote based on voting instructions received from all its customers). Where this is the case, J.P. Morgan will notify the Customer.

- Source

This explicitly grants the custodian bank power to proxy vote the entirety of its stock holdings of a corporation held across various different mutual funds in a single aggregate voting block.

For example, if JP Morgan Chase was the custodian bank of four mutual funds that all managed respectively 8%, 7%, 6%, 5% of one corporations stock, JP Morgan would have custodianship over 26% of that corporations stock and could vote all of it the same way on a specific issue, for instance board elections.

In this case, since they would be the only ones who have full access to all the different voting requests by the different funds, assuming those requests are made which they often aren’t, the bank can essentially say the consensus mandate was anything they want as they are acting as an information authority to the funds.

This is a grey area, and where sceptics of this article will point out that Custodian banks must only act on a mandate which serves the best interests of the customers they represent. They will also point to the multitude of different clausal arrangements which can find their way into the custody agreements between mutual funds and custodian banks.

However, if you look at the language of the agreements, the custodian banks merely need some vaguely defined mandate as justification for voting their blocks any way they choose. And such a mandate can be manufactured or simply ignored in any number of ways.

The greatest mandate for custodian bank control over voting blocks is being developed currently in the form of something called ESG policy.

Environmental, Social, Governance: The ESG mandate of social control

As we trend towards a future, assuming it hasn’t already arrived, where corporate control over social governance supersedes that of the State, then whomever controls the social governance policy of corporations effectively controls the social governance of society.

As this power is brought to bear in greater force upon non-market environments, what corporations will require is the manufacture of public consent for them to do so.

We’ve already established that a technocracy of middle managers control a corporations operational policy within a market, but do not control its social or environmental policies external to the market. This is instead governed by a third party called an ESG policy institute and implemented by a corporations CEO/Board.

You may have noticed that the role of the CEO over the last decade has changed. They have become less concerned with market operations and more concerned with corporate responsibilities to society. They speak publicly about issues of equality and what corporations can do to drive social changes more than they do their market performances. The CEO has become spokesperson and manager for a corporations ESG policy.

Now remember, the CEO is selected by the board of directors, who in turn are selected by the custodian banks; which makes CEOs beholden to custodian banks. Since the CEOs role has become the endorsement and implementation of ESG policy, and this policy governs the social aspects of society, it should be known who’s controlling the actual ESG institutes that create the policy. As the corporations themselves merely implement it.

The Coalition For Inclusive Capitalism

In the wake of the 2008 financial crises the City of London commissioned the Henry Jackson Society to produce a report called ‘Towards a more inclusive capitalism’. The report outlined the implications of a crises laden late-capitalist society and proposed a remedy. There where three key institutions and their representatives involved in the creation of the report:

- The Henry Jackson Society, Execution Director Alan Mendoza.

- McKinsey & Company, Global Managing Director Dominic Barton.

- E.L Rothschild, Chief Executive Office Lynn Forester de Rothschild.

The report concluded that “the only real solutions that can be put forward to restore trust in the system(capitalism), and which actually stand a chance of bringing economic prosperity, are being led by the private, rather than the public, sector.”

- Source

A long form explanation of the concerns the report addressed is outlined by Dominic Barton of McKinsey here. Essentially, the concern was less with the inequality produced by late-capitalism and more to do with the ripe environment for insurrection that inequality created.

In 2013 Lynn Forester de Rothschild co-opted the entire program into an actionable ESG policy institute called, The Coalition for Inclusive Capitalism (CIC). Since then the institute and its policies have been endorsed by a collection of CEOs and boards from the world’s biggest multi-national corporations and mutual funds.

The following is a list of organisations and their heads who have committed themselves to Inclusive Capitalism’s ESG policies:

- Ajay Banger, Chairman of Mastercard.

- Oliver Bate, Chairman of Allianz.

- Marc Benioff, Chairman and CEO of Salesforce.

- Edward D. Breen, Chairman and CEO of DuPont.

- Sharan Burrow, General Secretary of the Interional Trade Union Confederation.

- Mark Carney, Special Envoy for Climate Action and Finance of the United Nations

- Carmine Di Sibio, Chairman and CEO of EY.

- Roger W. Ferguson Jr, President and CEO of TIAA.

- Kenneth C. Frazier, Chairman and CEO of Merck.

- Marcie Frost, CEO of CalPERS.

- Alex Gorsky, Chairman and CEO of Johnson & Johnson.

- Angel Gurria, Secretary General of the OECD.

- Alfred Kelly, Chairman and CEO of Visa.

- Bernard Looney, CEO of BP.

- Hiro Mizuno, Managing Director of the Japanese Government Pension Fund.

- Brian Moynihan, Chairman and CEO of Bank of America.

- Ronald P. O’Hanley, President and CEO of State Street.

- Rajiv Shah, President of the Rockefeller foundation.

- Darren Walker, President of the Ford Foundation.

Recently CIC entered into partnership with the Pope and the Catholic Church, in what is called The Council for Inclusive Capitalism with the Vatican. The Vatican still remains an institute of moral conscious for millions around the world, and this blessing of CIC by the Pope serves to give the institute an actionable mandate on behalf of those people. No doubt the Institute has also been endorsed by a collection of Royals and Politicians, from Prince Charles to Bill Clinton.

The governance policy CIC provides corporations cover three areas: Employees, Environment, and Communities.

This policy framework used by Inclusive Capitalism is called The Embankment Project and its white paper can be found here: www(dot)coalitionforinclusivecapitalism(dot)com/wp-content/uploads/2021/01/coalition-epic-report.pdf

It’s a feedback loop system of control:

- Corporations provide CIC with non-market related internal data. Such as workforce demographics, environmental impacts, and employee personal data.

- CIC compiles this data and provides corporations feedback on what changes need to be made in the form of policy commitments.

- The corporations then implement those changes, supplying more data to CIC and the feedback loop continues.

- CIC monitors the data, informs changes, monitors the data, informs changes, and so on.

What CIC becomes is an information authority governing corporate social and environmental policy. These policies act as a mandate on Boards and CEOs.

Further more, CIC has a sub organisation called the Pension Fund Coalition, made up of mutual fund CEOs sponsoring the Embankment Project: www(dot)coalitionforinclusivecapitalism(dot)com/epic/

- Pascal Blanque, of Amundi,

- Thomas Finke, of Barings,

- Larry Fink, of BlackRock,

- Abigail Johnson, Fidelity Investments.

- MARY ERDOES, J.P. Morgan Chase

- CYRUS TARAPOREVALA, State Street

- William Mcnabb, Vanguard

As mentioned the founder and principal leader of CIC is a woman called Lynn Forester de Rothschild. This woman is likely to be one of the primary people Jeffrey Epstein was operating a hard candy blackmail operation on behalf of. The evidence for this is thoroughly presented here:Who is Lynn Forester de Rothschild

These are not nice people.

The future is corporate oligopoly bundled around a monopoly of violence. It will not look like anything we’ve come to recognise as dystopian. Because it won't be recognised it won't be stopped. The hope in this is found in that all of us who lived before it will be dead before it fully manifests. Those destinated to live in such a society may well enjoy it more than we have ours.

We are living through a transitory period of our civilization. Things are getting wild and as terrifying as it is, the adrenaline feels good doesn't it. The curtains have drawn, so enjoy the show, assuming it doesn't ruin you.