In light of Donald Trump appearing in the latest release of Jeffrey Epstein flight logs, it seems as good a time as any to take a look at how populists can be kept on a leash of controlled opposition through times when the centre of the political spectrum begins to buckle beneath the weight of naked corruption, and everyone flees to the fringes.

Just as Bill Clinton got his beak wet in Arkansas with eyes wide shut to CIA drug trafficking out of Mena airport; Trump got his with the acquisition of Resorts International (RI) at the tailend of the savings & loans crises of the 1980s. This isn't to say Trump was a clean man beforehand, only that this particular acquisition to his portfolio formed somewhat of a critical mass of naturally acquired dirt.

The Mary Carter Paint company had once been a paint company, but it was acquired in the 1960s and underwent a metamorphosis into Resorts international, a Bahamas-based business venture incorporating a diversity of shady dealings beneath its umbrella, from money laundering to CIA cutout private security firms 1 . Or as the New York Times puts it for the professional urban class in 1983, “a controversial developer of casinos and hotels in the Bahamas. Along the way the company etched a history that is checkered with stories about dealings with those who have had brushes with the law.” 2 .

The rabbit hole of Resorts International is a complex and expansive burrow beyond the purview of Trump, and better explored here. Though what is pertinent are the controlling interests that were behind it. At one point in the 1970s it would appear that a substantial portion of voting rights to its stock were being voted in proxy by the Castle Bank & Trust in the Bahamas, with the most substantial holder of this stock belonging to the Mellon family, which these days controls the largest custodian bank in the world, with over $45 trillion in assets under custody 3 .

"The bank was established by Paul Helliwell, a former OSS China hand with a background in drug-trade intelligence. After the war, Helliwell had run CIA front companies in Florida. Through his Bahamian bank, and a companion institution in Florida, millions of dollars were funneled for covert military operations staged off Andros Island in the Bahamas. Castle also facilitated tax evasion, and, in its trust-company capacity, voted the shares of certain nonresident owners of Resorts International, the top Lansky-era casino operation in Nassau. When one of their shareholder so strongly objected to the way Castle was voting his shares that he sued the bank, the scheme began to unravel. "The shareholder was William Mellon Hitchcock, the New York stockbroker who had been using the Paravicini bank of Berne, Switzerland, to circumvent the New York Fed's margin requirements...

– Hot Money, R.T. Naylor, pg. 315

The Mellons have always been on the. . .ahh, more eccentric side of financial oligarchy, and not unfamiliar with the pimptorial services provided by one Jeffrey Epstein either 4 . The Mellon's behave more like psychedelic aristocrats than they do financial oligarchs. A contemporary family scion, Christopher Mellon, has become a key figure within the UFO truther movement; managing to move seamlessly from deep state offices within the US government into casual podcast conversations with 'out there' thinking enthusiast Joe Rogan. More to the point however, William Mellon Hitchcock had been financing one of the world's largest LSD manufacturing operations back in the 1970s, right around the same time he had controlling rights of Resorts International 5 .

Anyhow, the crux of this article is about how Donald Trump's property portfolio was acquired through access to cheap credit made available to commercial real estate tycoons during the 1980s. At the beginning of that decade the banking sector had been deregulated through such acts as the Depository Institutions Deregulation and Monetary Control Act of 1980 and Garn–St. Germain Depository Institutions Act of 1982. Since Trump came from money, many believe he wasn't a 'self-made' billionaire and rather subsisted on the momentum of silver spoon wealth. But what Trump really was' was a 'bank-made' billionaire. As all his major acquisitions during that period, which made him a household name, were extremely leveraged. Trump's dad didn't buy him or hand him a commercial real estate empire, his banks did. And they've been his daddy ever since.

Estimates of Trump's wealth in 1980 range from $5 - $100 million depending on the axe to grind. Regardless, by 1990 Trump certainly was $3.3 billion in debt 6 .

Through this ten year period Trump either developed or acquired the following assets:

- Grand Hyatt Hotel. Construction began '78, with the deal involving his father and was leveraged by Chase Manhattan credit. Project completed '80.

- Trump Tower. Construction completed in '83 and was leveraged by Manufacturers Hanover Trust 7 .

- Trump Plaza Hotel and Casino. Construction costed $200 million and opened in 1984

- Trump Castle. Acquired from the Hilton family in 1985 for $320 million.

- Mar-a-Lago. Purchased in 1985 for $5 million.

- Plaza Hotel Manhattan. Acquired in 1988 for $400 million.

Both these projects began back in the late 70s prior to the aforementioned deregulation of the banking sector and Trump's father was involved, so would be fair to say he was handed these. However after these two Trump went out on his own, which is to say a credit binge.

However, the acquisition of interest was in '87, when Trump purchased majority stock position in Resorts International for $79 million 8 . Which would allow him to acquirec controlling rights to the then under construction Taj Mahal Casino the following year. The remaining construction costs of the Taj Trump financed through the issuance of just over $600 million in junk bonds, or Trumpbonds I suppose. This, on top of $2 billion in debt issued predominantly by three banks: Chase Manhattan, Citibank, and the Manufacturers Hanover Trust; had sunk Trump into a total of $3.3 billion debt by 1990. $1.3 billion of that in Trumpbonds he had sold to folks who would not be winning any time soon.

Yet explanations given these days for the crux to Trump's success seem to ignore all this. They focus on his character. That he ripped off contractors, litigated himself out of legal obligations, or the rather fantastical assertion that he pulled one over on the banks. In reality though, it was a couple of Rockefeller institutions handing him a golden ticket. And no doubt on his end Trump would've been obligated to ensure the casino assets under his control served their purpose— money laundering. Possibly a contributing factor to why they never turned enough profit to pay off the debts which acquired them.

James Crosby, the former chairman of Resorts International had died unexpectedly during a routine surgery in 1986, which had paved the way for Trump to become its majority shareholder. Aside from the Taj, Trump had acquired a motley assortment of assets in the deal, including some airline holdings. A 9% stake in Pan American World Airways Inc, which he bumped up to 17% through further stock purchases 9 , and the shuttle service fleet of 727s from Eastern Airlines, which was rebranded - Trump shuttle 10 .

This accumulation of Pan Am stock in 1987 would've put Trump within the business orbit of Jeffrey Epstein, who at the time was working on a takeover bid of that very company at Tower Capital.

“One of Epstein’s first assignments for Hoffenberg was to mastermind doomed bids to take over Pan American World Airways in 1987 and Emery Air Freight Corp. in 1988.”

Then if we then take Trump at his word, and math, he stated he'd known Epstein for around 15 years in 2002, which lands perfectly on 1987.

“I’ve known Jeff for fifteen years. Terrific guy,” Trump booms from a speakerphone. “He’s a lot of fun to be with. It is even said that he likes beautiful women as much as I do, and many of them are on the younger side. No doubt about it — Jeffrey enjoys his social life.”

– 'Jeffrey Epstein: International Moneyman of Mystery' , Landon Thomas Jr. , New York Magazine

On the other hand, the fleet of 727s Trump had acquired from Eastern Airlines had quite likely been ones used in a commercial scale drug smuggling operation not long prior to them being rebranded under his name. The 727s in question had been retrofitted with hidden compartments through the cabin, in what looked to be quite a sophisticated engineering operation. Perhaps such a thing is partly to blame for the missing luggage phenomenon many experience when travelling by air. Weight ratios must be precise.

“But a more common method of smuggling the drug from South America is simply to secrete it aboard a commercial airplane, in the wheel wells or the luggage compartment or behind the fiberglass walls of the lavatories.Thursday, U.S. Customs officials announced that they were fining Eastern Airlines $1.37 million because cocaine was found earlier this month aboard two of its Boeing 727 jetliners arriving from Colombia More than 1,700 pounds of the drug were stuffed into soft-sided suitcases and then hidden in the air conditioning compartments of the forward cargo hold. The street value of the cocaine was placed at $430 million.”

And if events surrounding Trump's acquisition of Resorts International weren't strange enough, a year after securing the Taj Mahal in this deal, three of his top casino executives all died in a helicopter crash. According to a witness there had been an explosion and the cabin had detached from the rotor and plummeted to the ground. 11 . An investigation into the matter concluded there had been hidden cracks in the rotor 12 .

It is right after Trump acquires RI that we also first have record of him floating a presidential image to the general public through a curated appearance on Oprah, a tv hostess famous for placing seal of approval stickers on the lapels of US Presidents as if they were strategically written books.

The 80s was a decade in which Trump was pumped full of cheap credit by Rockefeller banking institutions, taking advantage of the same deregulating acts that planted the seeds for the savings and loans crisis which unfolded at the end of it. It was an era more or less summed up as giant commercial property scam, of which Trump was just a part. If you are interested in this history an excellent accounting of what happened is given here:

Then in 1990 Trump began to default, first on his Trumpbonds then to the banks. The amount of debt he had managed to acquire was so egregious that the congressional committee on banking, finance and urban affairs launched an investigation into the matter that very year. But the banks told congress to fuck off and the whole thing died on the vine 13 .

Now, ordinarily this would be the part where the banks seize all Trump's shit and his paper empire crumbles. Which is exactly what happened to other real estate moguls who had fallen into credit traps. The commerical real estate portfolios of many built up over that yen year period got exposed as cadavers once the credit strings puppeteering them had been pulled. Yet miraculously for Trump, instead of mortgage vultures appearing to tear away at the flesh of his estate, it was a guardian angle by the name of Wilbur Ross Jr, sent to him by the financial gods at Rothschild Inc. Wilbur had been with the Rothschild firm for 15 years and was a senior managing director. He would later go out on his own in the late 90s just in time to gobble up bankrupt pieces of American enterprise in the wake of the dot com crash. His reputation in these matters made him somewhat of a legend on wall street, and in 2011 he was 'Grand Swipe' of the quasi-secretive wall street society, Kappa Beta Phi. A society which aims to "keep alive the spirit of the 'good old days of 1928–29.'" , and keeping it alive they are 14 .

More recently Wilbur Ross was the Secretary of Commerce in the Trump administration. An job he held for a full term, making him one of the few appointees Trump never fired. Another being William Barr. This was probably simply due to the fact Trump wasn't allowed to fire them.

Twenty years prior to this though, Wilbur had been appointed to represent the Trumpbond holders of the Taj Mahal, which had been the first of his debts he began to default on 1990. And with a classic art of the deal play, Trump had intially offered Trumpbonds as repayment for the ones he was defaulting on 15 .

While this offer was turned down, Wilbur, for whatever reason, did settle for a deal which allowed Trump to retain a majority stake in the Taj, even though Trumpbond holders had a first rate mortgage on it.

While that bank deal was touted at the time as a five-year arrangement, it later turned out that the negotiators focused almost exclusively on the money Mr. Trump and his enterprises owed to banks, while paying little attention to the money that was owed to bondholders. As a result, it was only a matter of weeks before Mr. Trump was again involved in debt talks, as the Taj Mahal casino was unable to make a $47.3 million interest payment on its bonds. Under the agreement reached yesterday, Mr. Trump will give up 50 percent of his ownership stake in the Taj Mahal. And depending on how much cash the casino is able to come up with to pay interest over the next 10 years, Mr. Trump could end up with 80 percent. Bondholders will get to keep 50 percent if Mr. Trump's organization avails itself of interest-rate concessions.

– 'A Bitter Pill for Trump and Maybe Another', New York Times, November 17 1990

The settlement gives the bondholders 50 percent of the equity in the Taj Mahal but leaves Mr. Trump with control of the board. Any transactions -- mergers, sales, recapitalizations -- that would substantially change the company are subject to approval by the bondholders' appointees, who will receive three of the seven board seats. In exchange, the interest rate that Mr. Trump pays on the bonds will be reduced to 12 percent, from 14 percent, and two percentage points of that can be paid in new bonds. The maturity on the bonds has been extended two years, to 2000. . . . He joined the conference call of nearly 100 bondholders, at Mr. Ross's request, and made it clear that he supported allowing Mr. Trump to retain 50 percent of the equity and control of the board. With the support of Mr. Icahn, Mr. Ross's group and the Japanese bondholders, who were now actively involved for the first time, it was clear to all those on the conference call that enough bondholders supported the deal to force it on the others. Some time after noon the conference call ended, and Mr. Ross and Mr. Icahn took the final offer to Mr. Trump, who agreed to it.

– 'Talking Deals; How Trump Got A Second Chance', New York Times, Nov. 22 1990

A few months prior to the Trumpbond dealings, the banks responsible for Trump's credit binge had made their own debt restructuring deal with him, which involved extending him even more lines of credit to service the ones we was defaulting on. They did put him on an allowance however to affirm the real power relation between them.

Yesterday morning, in the first part of a two-stage rescue for the 44-year-old developer, some of the nation's largest banks wired $20 million to a Trump bank account to help him meet a midnight deadline to make a $43 million payment to holders of some high-yield ''junk bonds'' backing one of his Atlantic City casinos. Mr. Trump provided the remaining $23 million in cash and bonds. The cost for Mr. Trump is that his bankers, who in the past had eagerly backed his grand visions, now have him on a short leash. His every move, including his personal expenditures, will be scrutinized. But he has maintained ownership of his empire, and in that small victory could lie the seeds of a comeback - if the real estate and casino markets cooperate. [Page D5.] If he had missed yesterday's payment, he would have defaulted on loans backed by Trump's Castle and probably would have lost that casino to creditors. Such a default would have set off a chain of defaults that could have forced him to seek bankruptcy protection. About 70 banks, with one German holdout, also approved a $65 million loan package for the developer yesterday that will defer much of his bank debt for up to five years.

– 'Banks Approve Loans for Trump, But Take Control of His Finances', New York Times, June 27 1990

The entire debt restructuring process was rather complex, often modified, and took place over a two year period, eventually finalised in 1992. Trump's debt obligations were ultimately handled in a two-fold manner. His Trumpbond debts were outsourced for restructuring to Wilbur Ross of the Rothschild firm, who helped him protect the assets he had acquired with them. While the banks, primarily Rockefeller institutions or creatures there of, allowed him to take on further lines of credit to service the ones from the 80s he was in the process of defaulting on:

“On Mar. 13, he is expected to conclude the final segments of a massive debt restructuring, which will give lenders the Trump Shuttle airline and hand over 49% of the Plaza Hotel in exchange for a lower mortgage-interest rate. . .

“He has been able to hang on to a major portion of his assets -- far more than most people thought possible. These include the core of his real estate and casino properties. Although he gave up a dozen assets (table, pages 76-77), he retains four major holdings, including the Trump Tower luxury high-rise. Plus, he kept half-ownership of three others, notably Manhattan's Plaza Hotel and the Taj. . .

“In return for the assets Trump is ceding to them, the lenders are reducing his empire's overall debt burden by a third, to $2.5 billion. That should enable cash flow from his operations to cover his interest tab. The lenders also are lowering his personal debt -- the portion guaranteed only by his signature -- from $885 million to $115 million. . .

“Prudential Insurance Co., a sizable holder of Taj bonds, initially wanted Trump's name and equity removed from the Taj. The Pru and other Trump-haters relented after a plea from their financial adviser, Wilbur L. Ross Jr., a senior managing director of Rothschild Inc. "The Trump name added value to the casino," says Ross. . .

“On June 30, 1993, two mortgages come due: $140 million for Trump Tower and $200 million for the Penn Yards. Will the banking syndicates holding the loans, both led by Chase Manhattan Bank, roll them over?”

Precisely during this period when Rothschild and Rockefeller institutions were cushioning the fallout of his credit binge, in fact precisely in 1992; that the first documented interaction between Trump and Jeffrey Epstein is found in some rather odd footage of the two at a private party Trump had organised, reportedly just for the two of them. Though also a camera crew, as the footage was found in the NBC archives.

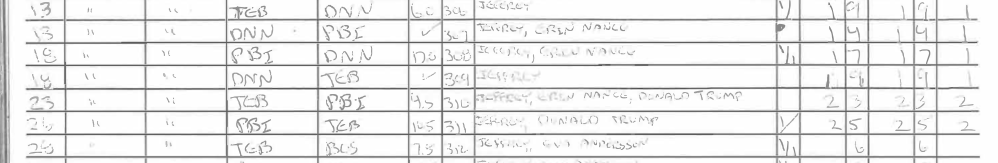

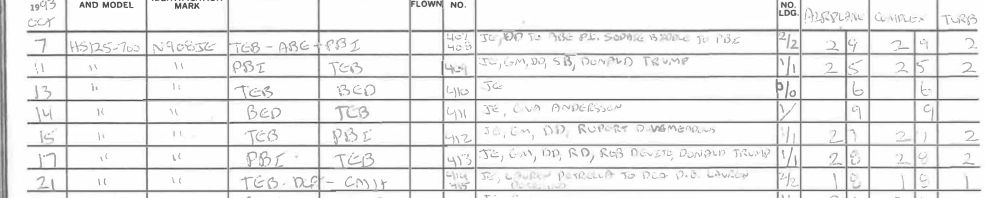

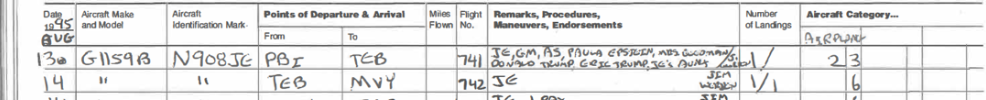

It is then in 1993 that Trump starts appearing in Epstein's flight logs. These logs, the latest of a batch released in discovery from the Maxwell trial, for the first time discloses the period between April 1991 and November 1995. A period during which Trump appears seven times and only once after.

1993 March 23: Trump, Epstein, and Erin Nance fly from New Jersey to Palm Beach. Then three days later on the 26th Trump and Epstein fly back to New Jersey. Erin Nance was Miss Georgia 1993 and first runner-up Miss USA 1993. She would later marry Albert G. Hill, great grandson of Texan oil baron H. L. Hunt 16 .

1993 October 11th: Epstein, Trump, Ghislaine Maxwell, Dawn Devito, and Sophie Biddle fly from Palm Beach to New Jersey.

1993 October 17th: Epstein, Trump, Maxwell, Rob Devito, and and 'RD' fly from Palm Beach to New Jersey.

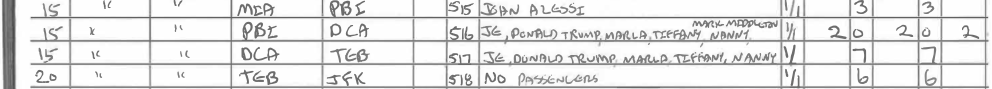

1994 May 15th: Epstein, Trump, Marla Trump(wife), Tiffany Trump(daughter), and Mark Middleton (Clinton White House aid) fly from Palm Beach to Washington D.C. Then fly from D.C to New Jersey without Middleton.

1995 Aug 13th . Epstein, Trump, Maxwell, Eric Trump, Paula Epstein fly from Palm Beach to New Jersey.

A lawsuit filed anonymously under the moniker 'Katie Johnson' in 2016 also alleged that between the months of June and September 1994, the plaintiff, 13 years old at the time, had been subjected to “extreme sexual and physical abuse” at a series of “underage sex parties held at the New York residence of the Defendant Jeffrey E. Epstein and attended by the Defendant Donald J. Trump” 17 .

Prior flight logs released to the public had excluded the period of Apr '91 through Nov '95 where Trump is listed seven times. After '95 he appears only once in '97. Which perhaps indicates that the relationship between Trump and Epstein was at its peak during the early to mid 90s; and while their relationship maintained until at least the early 00s, it probably waned thereafter.

The early 90s were seemingly a 'dark' period for Trump, but by 1995 it would also seem as if he was finally getting back on his feet. Wilbur Ross, still working for Rothschild Inc, was in the process of helping him gain back control of the Taj Mahal 18 . The Rockefeller banks no longer had him on an allowance and he was even allowed him to start acquiring new assets with new lines of credit. In 1996 he purchased 40 Wall St and turned it into the Trump Building. Then in 1998 he went in on a deal to purchase the General Motors Building for $878 Million, $700 million of which was loaned from the kind folks at Lehman Brothers. All these dealings giving Trump back the business mojo which would propel him into a subsequent era of new found fame with the success of his early 00s reality show, The Apprentice, and eventually the Presidency of the United States.

Before we continue, it must be pointed out that there still remains much confusion as to the precise nature of Jeffrey Epstein's activities. The official narrative purports his child sex trafficking and blackmail operation was isolated to himself and Ghislaine Maxwell, in some rogue aberration to the usual sausage making of politics. Though this narrative for the most part denies the blackmail aspect. Then on the other hand, the popular conspiratorial narrative embraces the blackmail aspect, but purports Epstein was an intelligence asset working for Mossad, or the CIA, or MI6, apparently all three.

Now, Epstein may have worked alongside intelligence agencies at times, as many do in high finance, but this cannot be conflated with working for them, which would be to say, as an asset 'handled' by an agent on the government payroll.

Though there is a third narrative, offered here, which is the most plausible, which is that Epstein actually did work in 'high finance', and worked for the same people intelligence agencies do(to a certain extent), this being the international financial fraternity. Specifically, the dynastic families(or institutional legacies of) making up the Anglo-American sect of internationalist financial oligarchs. The Rockefeller and Rothchild families.

We know Jeffrey Epstein operated in the world of high finance. We know he targeted three types of people with what appears to be a hard candy blackmail operation: upper crust politicians, new money technology entrepreneurs, and hedge fund/private equity managers. It also appears that he was operating as a high class pimp for old money men after preteen vice. The Epstein case isn't all that mysterious. He was a disposable charlatan putting a smile to the sordid. Just like Keith Raniere or Stephen Ward. His contact book leaked. His flight logs leaked. This isn't conjecture. Or evidence based on witness testimony which can be deceptively ignored as 'false memory' like in the Dutroux affair.

The whole intelligence asset angle is for the most part a red herring to attribute guilt to faceless three letter agencies. It is a theory popularised on the following base of evidence:

- An off the record report of a remark by Alex Acosta to government investigators looking into the leniency of Epstein's 2008 conviction, 'I was told Epstein worked for intelligence'. Reported by Vicky Ward.

- A photo-shopped picture of Ghislaine Maxwell at In-and-Out Burger reading a book about dead CIA spies, circulated online just after Epstein's death.

- A connection to Robert Maxwell through his daughter Ghislaine, and a book called 'The Assassination of Robert Maxwell: Israel's Superspy' linking Maxwell to Mossad.

- Les Wexner and the Megagroup. This is the most compelling evidence for intelligence agency involvement, as Epstein's intial foray into higher powers circle's appears to have been through Wexner. Due to this, some aspect of an intelligence network was almost certainly atleast aware of Epstein's operation, though there is no evidence to suggest anything other than an auxiliary connection to him. Nothing to suggest he had 'handlers' he was handing tapes to.

All but the Les Wexner tie is tenuous at best. A hamfisted photoshop of Ghislaine after Epstein's death. A line from an untrustworthy journalist like Vicky Ward. A connection to Robert Maxwell, who was actually in business with Rothschild Inc at the time of his death more than he was Mossad 19 . The theory doesn't play. Which is why when an investigative journalist like Whitney Webb, who does do great work, covers the Epstein case from this intelligence angle, the bulk of her investigation is spent exploring things unrelated to Epstein, or tied to him almost exclusively through one or two degrees of Les Wexner.

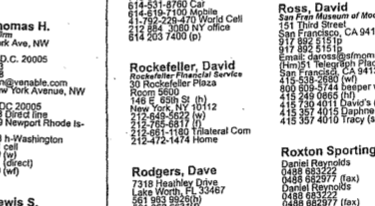

On the other hand, Epstein's ties to high finance are self-apparent. His ties to the Rothschilds are direct through Lynn Forester de Rothschild, evidence for which is thoroughly provided here. But he had also been a member of the Rockefeller Trilateral Commission, and David Rockefeller Jr was listed as a contact in Epstein's blackbook. While according Leon Black, David Rockefeller Jr had personally appointed Epstein as a director of Rockefeller University.

“Black was further impressed when he learned that David Rockefeller had appointed Epstein as a director to the Board of Rockefeller University. This appointment was consistent with Black’s understanding that Epstein was extremely knowledgeable about science and technology, as well as a strong proponent of scientific research and development.”

Leon Black was CEO of Apollo Management, a hedge fund in private control of the Standard & Poor's debt rating agency, which is one half of a global debt ratings duopoly it shares with Moody's. Together these two firms for the last three or four decades have allowed brokerage firms like merrill lynch to orchestrate debt securitisation scams which have become the high water marks of the modern business cycle. Black was also board chair for the Museum of Modern Art, a Rockefeller institution with a menacing list of directors cultivating the hubris of metropolitan intellectualism into one of the largest open source money laundering rackets in the world 20. Men like Leon Black, hedge fund managers, were one of the three prime targets of Epstein's operation given the importance of say, a credit ratings agency like S&P, to the overall process of wealth concentration within the top whatever % it is these days.

JP Morgan Chase, the resultant banking superstructure via the 2000 merger between Chase Manhattan and J.P Morgan banks is most likely very much still a Rockefeller institution. I cannot prove this, as banking secrecy jurisdictions, such as the State of Delaware or the broader City of London hub and spoke network of former British colonies, makes such a task quite literally impossible. Everything these days is owned by funds like Blackrock or Vanguard, who then in turn own each other. In regards to who controls these funds, ownership aside, the answer may exist somewhere on paper, though it's entirely possible controlling rights to the entire operation, in a legal sense, is ultimately determined these days through the implicit understanding of personal trust relationships and legally enforced, if need be, through the presentation of anonymous bearer documents in person.

Given this modern system for obfuscation of the controlling rights of financial institutions, it is at least reasonable to assume that the people responsible for creating such a network to hide themselves within, still retain control of it from the inside, even if this may no longer be true. It is at the very least reasonable to believe 'anonymous' financial institutions, such as JPMorganChase, are still controlled by Rockefeller interests, until such time evidence to the contrary presents itself. Which I am eagerly awaiting, as I can find none. The alternative to such an assumption is to accept the explanation offered up by these 'anonymous' institutions themselves. Which is that no one owns them. Which is to say they are owned by an indistinct mass of working class pension funds. So the workers. Which would suggest worker ownership of the means for production. So communism? But ownership is not control. Control is maintained by the funds themselves, and handed over to a group of custodian banks through global custody agreements. . .ones like BNY Mellon and JPMorganChase 21 .

Jeffrey Epstein's bank was JPMorganChase up until his 2008 conviction, after which his accounts were gradually transferred over to DeutscheBank, which would also become Donald Trump's primary bank after his dealing with Chase Manhattan and Citibank during 90s 22 . Jes Staley, who had worked at J.P Morgan in the 90s, picked up the Jeffrey Epstein account after his firm's merger with Chase Manhattan in 2000. Which perhaps indicates Chase Manhattan had been handling Epstein accounts in the prior period.

“The American banker (Jes Staley) has said he developed a relationship with Epstein in 2000, when he was hired to lead JP Morgan’s private bank, which handles wealthy clients. However, Staley stayed in contact with Epstein for seven years after he was convicted of soliciting prostitution from a minor in 2008, and visited Epstein in Florida while he was still serving his sentence and on work release in 2009.

– Jes Staley: why did the FCA investigate and are its findings public?, The Guardian, 2 Nov 2021

Another JPMorganChase banker of Epstein's, Paul Morris, actually migrated over to DeutscheBank with him in the aftermath of the 2008 conviction to handle his new accounts there.

“RELATIONSHIP MANAGER-1,” who brought Mr. Epstein into Deutsche Bank, is Paul Morris, who had previously helped manage the Epstein account at JPMorgan. Despite Mr. Epstein’s conviction in 2008 of soliciting prostitution from a minor and widespread press coverage of his involvement with underage girls, Mr. Morris in 2013 introduced Mr. Epstein to his Deutsche Bank bosses as “a potential client who could generate millions of dollars of revenue as well as leads for other lucrative clients to the bank,” according to the consent order.

But is any of this relevant? What about Trump's Russian connection! Well then. Let us ride that wave of mainstream conspiracy acceptability, which combers from way back in 2005 and a Paul Manafort connection to Russian oligarch Oleg Deripaska. As another connection to Oleg Deripaska back in 2005 was Peter Mandelson and Nat Rothschild.

“Kremlin watchers suspect it was Pechenkin who organised a swift entry visa for Mandelson when he turned up in Moscow to visit Deripaska three years ago. It was reported this week that Mandelson arrived by executive jet with his friend Nat Rothschild, Deripaska's adviser, but did not have the correct stamp in his passport. Mandelson, then EU trade commissioner, was allowed through immigration only after Deripaska's intervention, it was said.”

– 'Veteran KGB spy revealed as Deripaska's right-hand man', The Evening Standard, 29.10.08

“Mandelson had known members of the Rothschild family for many years. Rothschild is said to have been present at the dinner in Moscow in January 2005 with Mandelson and Deripaska. The three met again last August on Corfu, where Rothschild has a villa and where Deripaska moored his £80m yacht.

– 'Mandelson met oligarch earlier than he admitted', The Guardian, Fri 24 Oct 2008

The connection's Epstein had to the Rothschild family and Peter Mandelson are covered extensively in this aforementioned article. This isn't of much interest to the topic at hand, however if Trump's connection to Russia is relevant, then Trump's Russian connection's connection to Peter Mandelson and the Rothschild's must be relevant also. Since they both connection to Epstein, who then connects back to Trump.

While the Russiagate conspiracy theory was eating up the headlines, two under-appreciated aspects of Trump's administration flew under the radar. First was his appointment of Wilbur Ross as Sec of Commerce, the other his appointment of William Barr as Attorney General.

By this time then Wilbur was in his eighties and well above the theatrics of political theatre. And he made no effort to pretend he wasn't above it all. He walked about in ceremonial slippers, while instead of telling the President to “hurry it up” during speeches like a Don Regon -

He took a more laidback and somnolent approach, leaving everyone else to suffer through them.

Back in the early 1990s William Barr had been brought into the Bush Administration as Attorney General to clean up the fallout of the BCCI 'scandal'. After a long hiatus he was reinstated as AG by Trump for a brief stint beginning in Feb 2019, taking charge of the Federal Bureau of Prisons just in time to preside over the 'perfect storm of screw-ups, rather than any nefarious act’ which had led to Epstein's death in custody 23. As always, hanlon's razor is the go to when occam's posits the simplest explanation as a conspiracy. And the coincidences continue to this day, with Epstein's prison guards given a favorable plea deal for their valuable contribution to the screw-ups.

But behind all, and this in the background of the circus that what the Trump Presidency; a democratic congress, a republican senate, and his administration, all ganged up to deregulate the banking sector. . .once again. As such, there was a brief moment in history capturing the true ruckus nature of the modern political class banking institutions throw scraps of wealth to off their dinner plates. A moment of mass celebration for a diversity of wealth creation at the top, in the name of diversity at the bottom. Remember, loose lips sink ships, and growing wealth disparity is offset by a parity of those accumulating it. Think inflation and growth targets, but with a diversity of boots stomping on masked faces to deafening applause.

Refs:

- 'The Hughes-Nixon-Lansky Connection: The Secret Alliances of the CIA from WW2 to Watergate', Howard John, Rolling Stone Magazine, Issue 213, 1976

- 'RESORTS INTERNATIONAL UPS THE ANTE', Leslie Wayne, Nov. 13 1983, NYTimes.

- https://www.bnymellon.com/us/en/about-us/newsroom/press-release/bny-mellon-to-speak-at-the-goldman-sachs-2021-us-financial-services-conference-130235.html

- https://thehotstar.net/epstein-mellon.html

- 'OIL MILLIONAIRE KEY IN DRUG CASE', New York Times, Jan. 28, 1974

- 'FINANCIAL CRISIS TESTS TRUMP LEGEND', Chicargo Tribune, June 10, 1990

- 'THE EMPIRE AND EGO OF DONALD TRUMP', New York Times, Aug. 7, 1983

- 'TRUMP BUYS 73% STAKE IN RESORTS FOR $79 MILLION', New York Times, March 10, 1987

- 'TRUMP'S INTEREST IN PAM AM', New York Times, June 18, 1987

- 'TRUMP BUYS EASTERN'S AIR SHUTTLE', Washington Post, October 13, 1988

- 'Copter Crash Kills 3 Aides Of Trump', New York Times, Oct. 11, 1989

- 'Hidden Cracks Found in Rotor In Trump Crash', New York Times, Oct. 14, 1989

- Investigation by Committee on banking, finance and urban affairs, August 9, 1990

- Revealed: The Full Membership List of Wall Street’s Secret Society, New York Magazine, February 18, 2014

- 'New Bond Request By Trump', New York Times, October 19, 1990

- Oil heir Al G. Hill III and socialite wife charged with mortgage fraud, Dallas Morning News, Apr 4, 2011

- Katie John V. Donald J. Trump and Jeffrey E. Epstein, Case Number: CV16-00797

- 'Trump Enlists Help for a Taj Mahal Plan', New York Times, February 03, 1995

- 'MEAGDEALER FOR THE ROTHSCHILDS', New York Times, Dec. 4, 1988

- Cruel World of Modern Art, this site.

- Separation of Control from Ownership, this site.

- 'Deutsche Bank and Trump: $2 Billion in Loans and a Wary Board', New York Times, March 18, 2019

- 'Barr Says Epstein’s Suicide Resulted From ‘Perfect Storm of Screw-Ups’, New York Times, Nov. 22, 2019