The US Fed started rate hikes February 1st 2022. Long-term US govt bonds auctioned from this date started to take on higher and higher interest rates, which are fixed and due to be paid every six months from the issuance date for the bonds duration.

These are the price charts for US 10-year, 20-year, and 30-year bonds from that date.

Notice the massive price crashes leading into the start of February, May and November 2022. Followed by massive restorative price spikes in the middle of those months. These price spikes occur on the days of the 10Y, 20Y, and 30Y bond auctions held in February, May and November.

The higher the price of a bond at its date of auction, the lower the rate of interest assigned to it, which is fixed for its duration and paid every six months from its date of issuance.

Interest payments on the bonds from the February auction are due on the 15th of February and August each year.

Interest payments on the bonds from the May auction are due on the 15th of May and November each year.

Interest payments on the bonds from the November auction are due on the 15th of November and May each year.

Since the beginning of interest rate hikes in 2022 there have been three bear market rallies, or brief periods of respite from the market crashing.

All three commenced about a month after the bonds auctions held in February, May, and November. The first two rallies, that of mid-late March and mid-June to mid-August, exactly one month after the bond auctions. The third rally, which we currently reside in as I write, that of late December to Mid-February, occurred a little over a month after.

And so we see a pattern. About a month after these bond auctions the stock market rallies to a point higher than it was on the auction date. But this was true only for those auctions preceded by a massive price crash in the runup to the auction date.

If someone had used the date of bond auctions alone without this qualifier as a buy signal, they would’ve got rinsed after the bond auctions of August where this wasn’t observed. Neither has it been observed in the most recent auctions of February 2023.

In fact, the bond auctions in August marked the exact top of the largest bear market rally in 2022 and the beginning of the next leg down. And the same would appear to be true for the auctions of February 2023, putting an end to the current rally.

If this holds true we see a clear pattern. Massive price spike on bond auction date = bear market rally about a month later. No price spike on bond auction date = No rally and the next leg down.

This seems obvious enough. When bond prices crash the stock market follows. When bond prices stabilise the stock market follows. The price of bonds is the volume of music. When it dips below a certain level the music stops.

But why does the music play between the auctions of May and August. Then stop between the auctions of August and November. Then play gain between the auctions of November and February?

Each bond auction is followed by two months of “reissues”. Which are auctions of the same bonds with the same rate of fixed interest sold at whatever the new price is. So the bond auctions in May had reissue auctions in June and July.

Tthe price remains stables and the stock market rallies. Right up until the new auctions in August, after which the price of bonds begin to fall through the August reissues in September and October. And stocks follow.

Then the price is restored in the November auctions and maintained, even increased, right through until the auctions in February. During which we see another bear market rally.

The higher the price of bonds on the date of auction, the lower the interest rate. And this interest rate is due every six months from the date of issuance, which is always on the 15th of the month of auction.

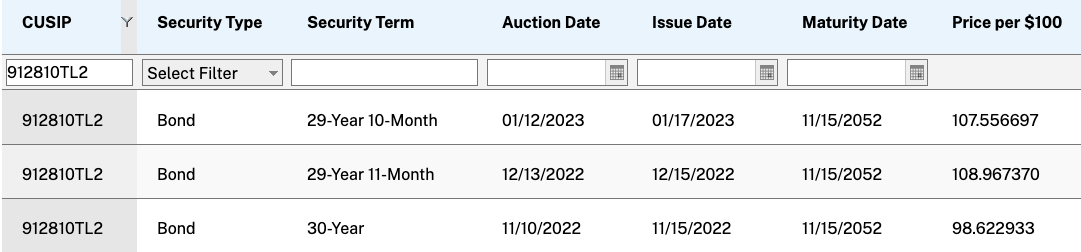

Given that the price of bonds was much lower for the auctions in May and November than those in February and August, the increase of interest rates attached to bonds auctioned in May and November are much higher.

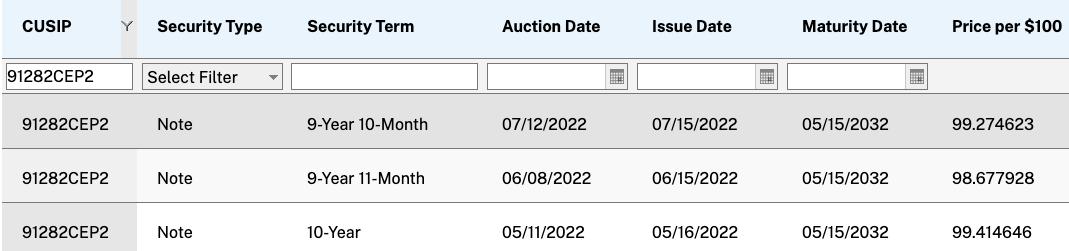

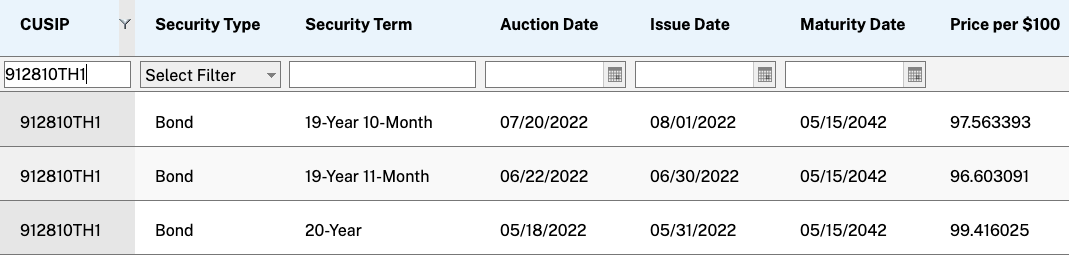

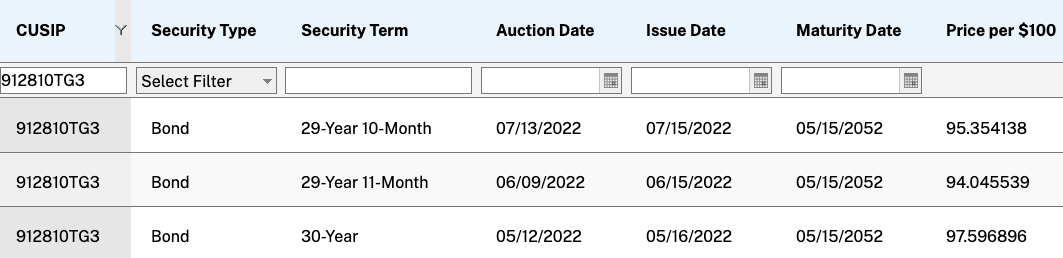

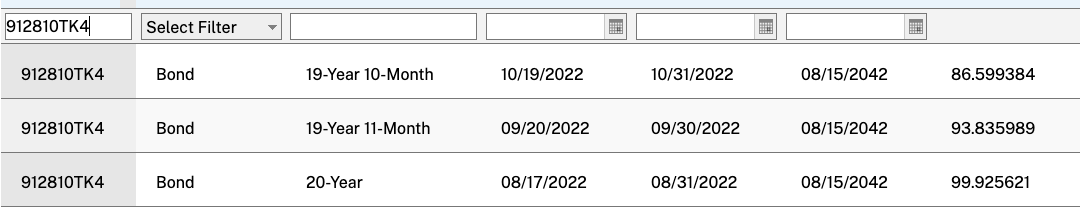

February 2022 Auctions

10Y 1.87%

20Y 2.37%

30Y 2.25%

May 2022 Auctions

10Y 2.87%

20Y 3.25%

30Y 2.87%

August 2022 Auctions

10Y 2.75%

20Y 3.37%

30Y 3%

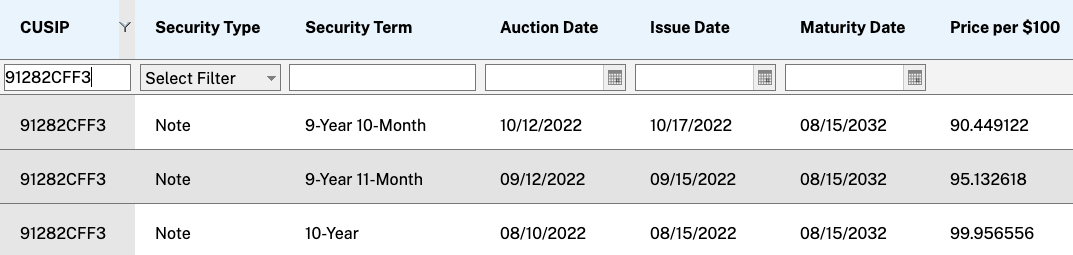

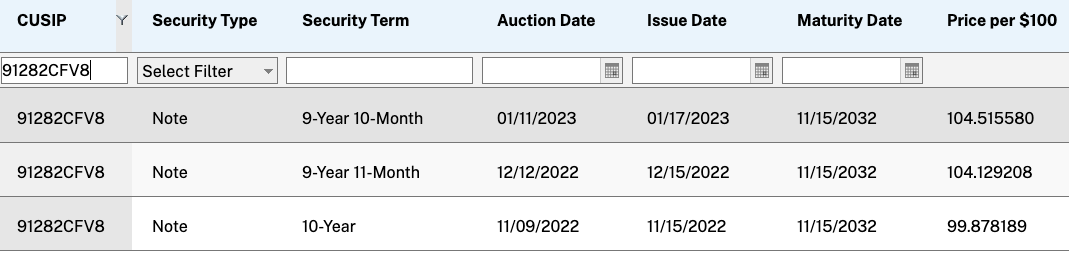

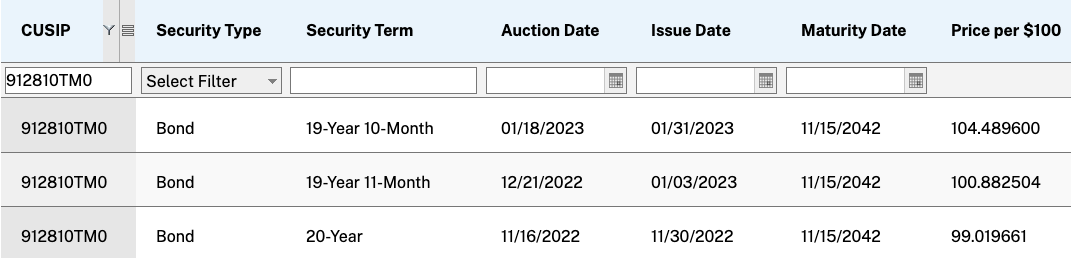

November 2022 Auctions

10Y 4.12%

20Y 4%

30Y 4%

February 2023 Auctions

10Y 3.5%

20Y (Yet to Occur when written)

30Y 3.62%

Since these interest payments are due every six months from the 15th of the month of auction, bonds auctioned in May and November have synchronised interest payment dates of May 15th and November 15th, while bonds auctioned in February and August have synchronised interest payment dates of February 15th and August 15th.

May & November 15th - payments on higher interest bonds due.

February & August 15th - payments on lower interest bonds due.

In the lead up to payments on the higher interest May/Nov bonds there are massive price crashes. Which means bondholders are selling them.

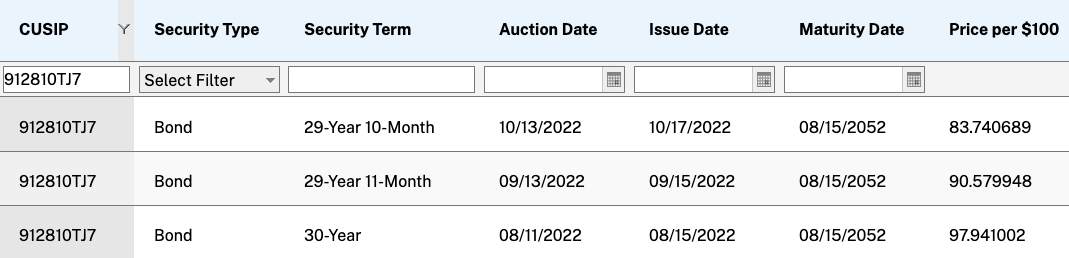

May 10 Year Bond

May 20 Year Bond

May 30 Year Bond

What could cause the stock market to rally after the auction of May bonds, and then a crash in the price of May bonds just prior to the November auctions when interest on them is due?

Margin leverage followed by margin calls.

If bonds bought in May were used as collateral for margin loans, this could spark a rally in stocks. If this rally was then followed by a drop in the price of bonds, this could trigger margin calls and a forced selloff of all those bonds being used as collateral before the interest was due to be paid on them.

As it happens, pension funds all around the world have, for the past decade, been using a new financial mumbo jumbo conjured up in the wake of the global financial crisis. They call it Liability Driven Investment (LDI).

What Liability Driven Investment is’ is simple. A pension fund purchases a long term government bond. Then uses this bond as collateral to take out a cash loan they invest in stocks. This is just a margin loan. And it triggered a collapse in the price of UK bonds in September 2022. The value of long term Uk government bonds fell below a price which forced pension funds using them as collateral to sell them, which forced the price down even further forcing more pension funds to sell them in a sort of death spiral.

Much was made of this event though little attention was paid to what had actually happened. As you can see from the charts the price of UK bonds started crashing around the middle of August, a month before Truss announced her budget in September, which was just a cherry on the cake.

What actually happened is the central bank graciously repurchased bonds they’d auctioned to pension funds forced to sell them at decades low. The central bank then resold these for a profit a few months later.

“Practically laughing at the pivot folks, the Bank of England announced today that it sold the entire £19.3 billion in UK government bonds — £12.1 billion of long-dated conventional gilts and £7.2 billion in inflation-protected gilts – that it had purchased between September 28 and October 14 during the UK pension fund crisis that had threatened to send contagion in all directions. And it sold the gilts for £23.1 billion, making a profit of £3.8 billion, or 19.7% in about three months!”

This wasn’t an isolated event. It happened in the Netherlands as well earlier last year.

Last year, the Netherlands saw a drama which might seem familiar to UK investors. Within the first six months of 2022, Dutch pension funds sold €88bn (£77.1bn) in assets, this amounts to nearly 5% of their total assets, according to Dutch central bank DNB. Assets managed by Dutch pension funds dropped to €1.4trn (£1,2trn), from €1.8trn (£1.5trn) last year.

The reason for these outflows is the growing costs of collateral calls on DB scheme’s derivative positions. Amid rising interest rates, these derivatives turned out to be an expensive hedge to hold. The resemblance between the Dutch and British LDI crisis is uncanny.

BlackRock was the primary provider of LDI services to the UK pension funds which had received margin calls, and they provide these same LDI services to US corporate pension funds.

In August 2019 BlackRock published a white paper proposal to become a bond purchasing agent for the US Fed. This proposal was accepted a few months later as part of the emergency measures in response to the pandemic. Larry Fink’s protege Wally Adeyemo operates inside the Treasury as deputy secretary. All the mechanisms and levers are there for a controlled demolition. Music on. Music off. Music on. Music off. If this theory holds the following will happen.

In a few days on February 15th the price of the 20 year bond will crash more than -5%. Bond prices will continue to crash until around May 8th-15th 2023. The US stock market will follow and crash to new lows. Then in May, if we see a restorative spike in the price of bonds during the auctions, expect another bear market rally until August. If not, then down into the abyss.