The modern economy is based on debt. The creation of its reserve currency for foreign exchange, the US dollar, is backed by debt through the Federal Reserve’s bond purchasing program with the US Treasury.

The Treasury writes an IOU on a piece of paper and exchanges this with the Federal Reserve for fiat currency. Since the fiat currency is backed by the debt used to create it, if this debt is never repaid then the fiat currency is not actually backed by nothing, but less than nothing.

If this doesn’t make sense, it’s because it doesn’t. US debt is now at $28 trillion and rising, while the discussion over how to service it is no longer entertained.

If the debt doesn’t need to be paid off—ever, then modern monetary theory would be correct and central banks these days no longer use a money printer but a philosopher’s stone. They will have discovered the perfect mix of ingredients to create sound money from nothing at no cost. Which would mean that the debt used to make money is just wastage, a giant rubbish tip of exhausted ingredients which can be left to decompose.

On the other hand, if the debt needs to be dealt with at some point, and using currency already in circulation—not servicing debt with more debt—then there are only three options the US government have:

- Taxation

- Repudiation

- Inflation

Taxation Option

This requires increasing the amount of real wealth so that it can be taxed at a rate which provides the government with a surplus used to pay off the debt. The problem with this is twofold.

Firstly, modern monetary policy produces real wealth through debt, which is what has to be paid off. Thus, the solution to a problem cannot be the problem itself.

Secondly, raising taxes without raising the real wealth of the tax base is unpopular and politicians don’t like making unpopular decisions if they don’t have to.

Repudiation Option

The government simply says it won’t pay the debt. As a result all government bonds become worthless and bondholders take the loss. Trust in the government is lost and the ability to finance future spending through bonds sales is diminished. Which means future spending will have to rely heavily on taxation, making the government even more unpopular.

Inflation Option

Currency the debt is payable in is devalued through inflation of it. The more currency is inflated the more devalued the debts payable in it become. If inflation is left to become hyperinflation, currency will begin to spiral towards worthlessness. As currency approaches the point of worthlessness, the debts payable in that currency approach worthlessness too. This is because at such a point the cost of paper or any other means for billing, begins to cost more than the debt it collects. Thus it becomes no longer profitable to collect debt, even if it technically still exists.

This is similar to Repudiation only all debt is erased, not just the governments. The government also never has to outright refuse to pay its debt, rather, the holders of it are compelled by the economic environment never to collect.

However, a gradual inflation, which has been the doctrine of modern monetary theory—being around 2%, can never solve the debt-crises precisely because the means for devaluing the debt creates more of it. Thus, the increase in debt offsets the devaluation of the currency it’s held in.

This means the only true way to solve a debt-crises through inflation is to ensure that it becomes hyperinflationary to the point money becomes worthless. And this requires a currency reset.

Currency Reset

Once currency becomes worthless it needs to be replaced with a new currency. This is called a currency reset.

The worthless currency is pegged to the new currency at an extraordinary rate of exchange, such as 1:1,000,000,000. Banks then discontinue credit lines in the old currency and issue them elusively in the new one.

Out of economic necessity people quickly adopt the new currency and leave the old one behind. At which point currency has been reset with a new stable one, and all debt left behind in an old worthless one.

In whose best interest would a currency reset be?

Put simply, those in the most amount of debt, but let's explore this.

The two institutions which determine how US debt is managed are the US Government—specifically the Treasury Department, and the Federal Reserve.

Institutions are vested interests, and will always act accordingly.

Of the three aforementioned remedies for the current debt-crises, assuming there is one, it could be speculated by some(me), that the one most likely to be chosen would be that which serves the best interests of both the US Government and Federal Reserve.

The government can’t realistically service the debt through taxation. The amount of tax which would have to be raised to pay off $28 trillion would require major hikes in the highest bracket. The people in this bracket are experts at not paying tax and there’s a global infrastructure of financial secrecy jurisdictions to assist them in this. So just raising taxes wouldn’t be enough, the government would also have to dismantle this tax avoidance network, which spans far beyond its jurisdiction, just to taxes from a group of people that would’ve already exodused the country at such a point. Put simply, this is not an option because austerity measures would have to be placed upon those with the power to reject them.

So taxation seems unlikely.

The government could repudiate the debt. Though this would be against the interests of those who hold government bonds. The biggest buyer of government bonds is the Federal Reserve. If the Federal Reserve refuses to buy government bonds then the Government must fund itself through raising taxes. Since it cannot effectively collect higher taxes in the upper brackets, it must collect them from the lower brackets, which is very unpopular with the majority of voters.

The pensioned middle classes are also major holders of government bonds. By repudiating the debt the government fucks over the middle classes who are never repaid, and then also has to raise taxes on them because neither they nor the central bank will want to buy its bonds anymore.

So while the government rids itself of a debt-crises, it does so at the cost of a funding crises and mass unpopularity. A government which does this is unlikely to survive the next election, which is why it only generally done by governments without such an affliction.

Repudiation in a nation of voters would require a current government placing the blame of past governments squarely on itself, only to help erase the debt of a future government, who are likely to be their replacement.

The transient nature of election cycles means the debt is handed down and added to as no self interested politician in their right mind would want to become the debt martyr. Such a thing is simply beyond the politicians nature.

If the government is incapable of ever dealing with the debt, then the only other option is the Federal Reserve. Which leaves currency reset and seemingly the only option.

When a currency resets, holders of government bonds are fucked over just as they are when a government repudiates that debt. However, in this case the government isn’t at fault as monetary policy is the responsibility of the central bank. As far as the government knows, their debt has been wiped away, the central bank is primarily at fault, and they don’t have to raise taxes. And all they've had to do on their end is pass popular public spending bills.

But it isn’t just government debt wiped away, but all debt in the old currency. Which means currency reset is an economy wide zero-sum game. Debtors win and creditors lose.

Broader economic interests

In early March of 2020 the stock market crashed sharply as it became apparent economies would be going into lockdowns.

On march 15th it began a swift recovery when the Federal Reserve announced(source) interest rates would drop to near zero and that the fractional reserve ratio previously required of retail banks had been abolished. The latter meant retail banks could theoretically loan out infinite amounts of credit at almost no interest.

Since then this cheap credit has poured into the economy in mostly three ways:

- Leveraged buyouts

- Stock purchases

- Property purchases

The lending measures by the Fed instantly initiated a stock market boom. The market has been suckling on this credit ever since, up until the present moment as I’m writing this, where it appears to be teetering out as the first “clear” signs of “unexpected” inflation begin to show. There are fears now that the Fed will stop breast feeding it cheap credit to combat inflation. However, if the Fed is in planning a currency reset, then the market has nothing to fear for now, as it will be needed to further hide the expansion of the money supply.

The stock market is important for the creation of hyperinflation as it prevents cheap credit from spreading out across the economy, where it would hike commodity prices and become noticeable.

Instead the credit blows bubbles in the stock market where it stores, and no one notices this over the frenzy of trying to become rich.

This allows the Fed to keep expanding the supply of money while hiding the inflationary effects of doing so. It’s all about buying time for the seed of hyperinflation to grow. And when the stock market eventually crashes of course, all that stored up cheap credit floods out all at once and into everything else, which becomes the spark sending prices over the edge and into hyperinflation.

For this reason, if the Fed where wanting a currency reset, then the stock market would be their greatest weapon for doing it, and would have to nurture the market on its breast for as long as possible until just the right time.

Retail bank credit has also been blowing bubbles in the property market. If interest rates are held down long enough, and hyperinflation unfolds quick enough into a currency reset, then all that debt used to purchase property could be repaid with the value of a cup of tea before banks can foreclose on it. Thus, those who know what they are doing or have cosy relationships with credit lenders are currently going into to debt to buy up whatever they can get their hands on at whatever price, knowing that the value of their assets will soar and the value of debt used to purchase those assets will plummet.

As the Fed uses retail banks to blow up private sector spending in the corporate, stock, and property markets; it is also buying government bonds to blow up public sector spending. It cannot hide the latter and needn’t do, as government spending and stimulus checks are supported by the majority of people who assume it’s going to them, and is only opposed by the minority of people it mostly goes to.

The central banking interest

The Fed isn’t a self contained interest group, rather it is a node in a globalised central banking network governed by a nexus acting as a central bank for central banks, called the Bank For International Settlements(BIS). The BIS probably has one of the seediest histories of any modern institution, though that’s beyond the scope of the discussion here.

The primary interest of the BIS is to maintain control over global currency markets and foreign exchanges through a top-down governance policy framework. It acts as an information authority to central banks subscribed to its policy frameworks, such as Basel III, through subscription tiers like the G7 and G20 forums.

The Feds interests are internationalist and share the BIS agenda, which is maintaining control over universal exchange currency.

In January 2020 the BIS announced(source) an agenda to develop a Central Banking Digital Currency(CBDC). The CBDC is still quasi speculative at this point so the form it will take is uncertain, but generally speaking it is a centralised digital currency distributed distributed directly to consumers, thus cutting out the middle man position of retail banks possibly.

There are many reasons why the BIS and governments would want to replace the current debt-based currencies with CBDC. Most importantly it secures the position of Central Banks within an emerging economic environment of crypto- currencies utilising anonymous transaction ledgers. The technology driving this is blockchain infrastructure. It is decentralised, anonymous and autonomous, and because of this threatens the BIS, which is a transaction ledger itself.

So in adapting to this modern environment, the BIS is seeking to take blockchain technology and morph it into a fully centralised and monitorable transaction ledger under their control. They will then ensure that their version of blockchain becomes the standard universally adopted.

Them accomplishing this is inevitable, the only thing in question is the timeline and ultimate form it will take. China’s central bank has already rolled out CBDC and is experimenting with the possibilities of the technology through such things as providing economic stimulus payments which have a time expiry, thus ensuring it serves its purpose.

The biggest hurdle for CBDC is the initial introduction of it. If there are alternatives available providing things CBDC cannot adoption will be slow. CBDC cannot provide anonymity. Which means all currencies which do are a threat to it. Some more than others, the main one being cash, which is the only means available to the working classes for tax avoidance. Currencies like bitcoin aren’t really a threat as they can never been scaled to become a universal exchange standard. And if even if they could, the mining infrastructure which facilitates autonomous transactions is easily regulated and abolished by any government on environmental grounds, which is currently in the works. Further more, like anything digital, crypto-currencies and their ledgers are susceptible to cyberattacks in some way or form. Barring all else these currencies rely on the material infrastructure of the internet, which is controlled by interests subservient to the central banks.

Thus, it is not the digital alternatives to CBDC which threaten its adoption, but the analogy properties of cash providing anonymity for day to day transactions. You could call cash completely decentralised grassroots currency as there is no transaction ledger other than the one people may choose to keep.

The only way to get rid of cash would be to outlaw ownership of it. This would be an unpopular decision for a government to have to make, and an unnecessary one too. Because people will throw cash away themselves if it becomes worthless.

The only way to make cash worthless is through hyperinflation, which is the means for gaining the mandate of a currency reset.

The following is what a hyperinflation toward a currency reset onto CBDC would achieve for those with an interest in them:

- Makes anonymous cash worthless

- Makes the introduction of centralised CBDC a necessity

- increases government spending and then erases government debt

- increases corporate growth and then erases corporate debt

- Increases the wealth of the asset rich.

The only people who lose are the middle classes whose savings are used to purchase government bonds. The lower classes without savings have nothing to lose and also gain stimulus checks as part of the process. They will suffer during the actual hyperinflation period itself, but if this period is short and quick, like a band-aid rip, then there shouldn’t be too much damage caused by the resulting civil unrest.

A currency reset is in the best interests of all those who have the power to do it. And the only time they could get away with it is right now, during this pandemic, while the whole world is in a state of confusion.

As I write this inflation has begun to rear it’s head. The stock market is feeling rather uncertain as it assumes the Fed will crunch credit. But a currency reset is on the agenda then it won’t do this. This is because CBDC is still in developmental phase at the BIS and isn’t ready to be rolled out. This means interest rates must stay down so the market bubble holds until the time it needs to be popped to ignite hyperinflation.

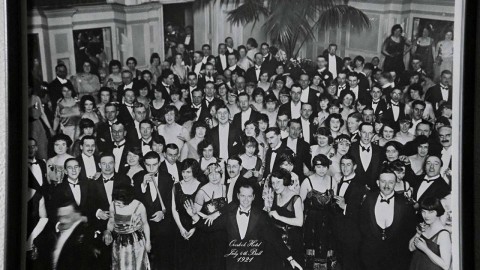

The current trend we are on is very similar to Wiemar Germany exactly a century ago.

1919 - Post war money creation begins

1920 (start of)- Stock market boom begins

1921 (end of) - Stock market begins to decline

1922 - Stock Market begins to crash and hyperinflation begins.

1923(November)- The Reichsmark becomes worthless. The Rentenmark is rolled out pegged at 1 trillion Reichsmarks.

If we are to follow the Wiemar trajectory then things will begin to kick off in June/July 2021. So a couple months from now, being May 2021. Events would synchronise perfectly a century apart from some kind of obsession for round numbers.

It’s hard to tell when the BIS would be ready for a CBDC currency reset. The BIS appears to be past the planning stage and well into development one(source). What follows next is rollout.

It would be safe to assume the technology is ready, as China’s Central Bank has already rolled it out domestically, meaning Chinese CBDC is ready to be plugged into the BIS foreign-exchange backbone.

The fallout of currency reset

There can be no consequences for the actions which cause it, as these are explained away as unfortunate and unforeseen externalities in response to an unprecedented global crises. Governments can blame central banks and the pandemic. The private sector can blame government spending. And central banks needn’t explain themselves as they aren’t elected by people or regulated by governments, but will probably elude to the broader economic environment induced by the pandemic.

The public will be bamboozled by a new industry of takes. Sycophants of all kinds will be ready to bend the knee for a chance to sign onto the Bertelsmann-Springer monopoly’s mass publication of carbon copy books loosely entitled “The Crises. What happened.”. Ultimately it will resonate in history as a complicated mixture of various causes explaining away intended effects. Initially, anything which suggests there was intention will be deemed too simple an explanation for too complex an economic landscape. After a universal narrative is set, anything which suggests an alternative of strategic planning will be deemed too complex and outlandish on the principal Occam’s razor. It will simply come down to incompetence in crises.

Anyway, stay the fuck away from government bonds and enjoy the show. They certainly did a century ago.